Building Strategy

What Is A Strategy?

A trading strategy is a systematic method used for buying and selling a instrument in market. It is based on predefined rules and criteria used when making trading decisions.

Building Strategy With Qodrr

To build a strategy, you can follow the steps given below:

-

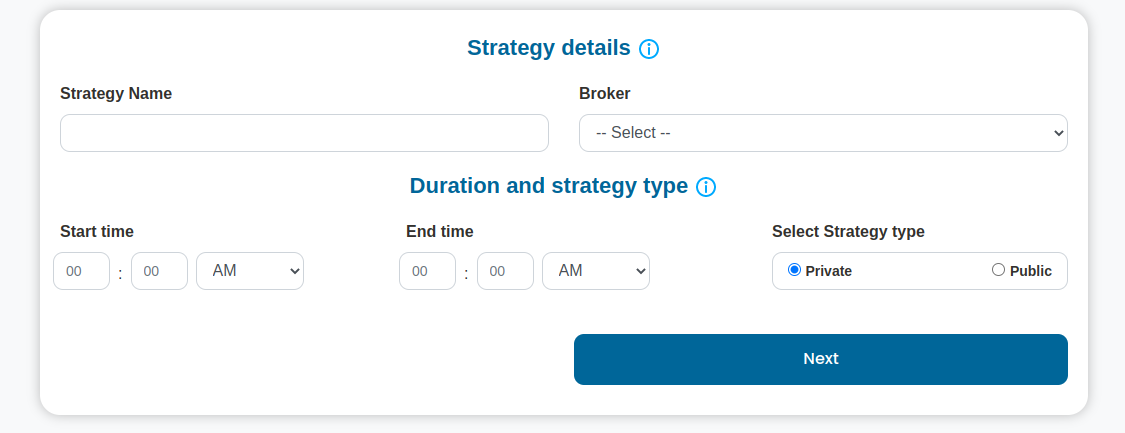

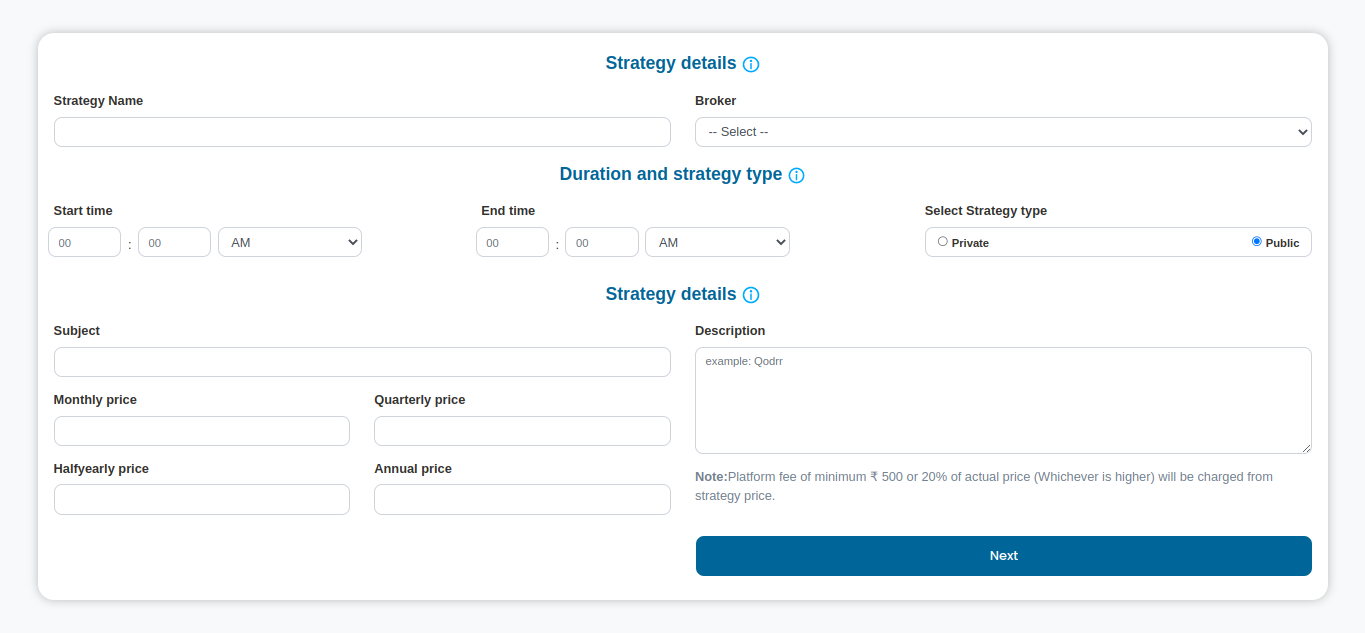

Step 1: Basic Details -

Fill in the details such as strategy name, your broker, start time and end time, and whether the strategy is public or private. Then click on the Next button.

-

Strategy Name - A Strategy name is what your strategy is labeled by. It should contain ten characters or less and may include underscore(_) or dash(-).

-

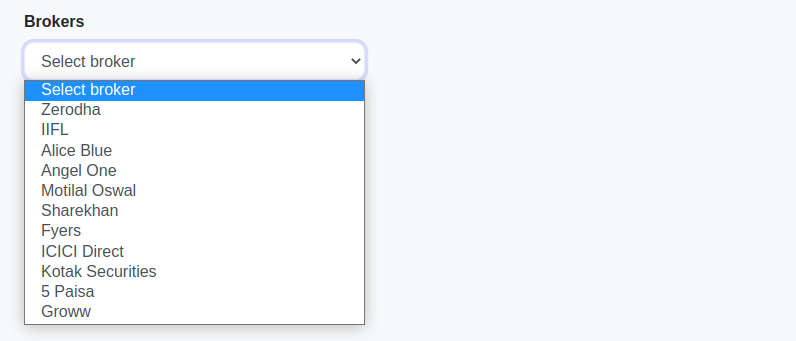

Broker - Select a preferred broker,where you wish to execute your trades and place orders. Some of the Brokers available on Qodrr are Zerodha, Angel One, IIFL, Alice Blue, Motilal Oswal, and 5 Paisa.

Note

At this moment,we are supporting Zerodha, AliceBlue, Angel One, IIFL brokers. Other broker integration are in progress.

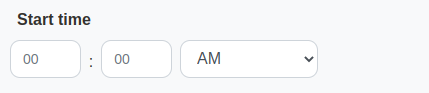

- Start time - The start time will execute the given strategy at the given time. For example - If the start time of a strategy is 10:00 am then it will be executed at the given time.

Note

Indian Equity & Derivative Market starts at 9:15 am IST as of now. And MCX Market starts at 9.00 AM IST.

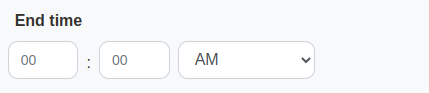

- End Time - The end time will determine the time to stop the executed strategy. For example - If the end time of a particular strategy is 3:00 pm then it will end at the given time.

Warning

For Intraday Strategies, End Time will decide the Square off of trade. It's advisable to define End Time well in advance of broker's auto square off of the trade.

-

Strategy Type - The strategy type determines whether it is a public or a private strategy. A private strategy will not be listed anywhere, only you will be able to see it in the Your Strategies Panel whereas a Public Strategy will be listed on the marketplace.

If the strategy is a public strategy we need to fill in some more details like the subject, description, monthly, quarterly, half-yearly, and annual prices.

-

Subject - The strategy subject is a meaningfull headline for public strategy.

-

Pricing - Here you can assign prices to your strategy on a monthly, quarterly, half-yearly, and annual basis. The prices should be a minimum of ₹ 500.

-

Description - Here, you can describe your strategy, through which users can get brief about your strategy.

Important

Public Strategy Creation is only available through certain subscription plans in Qodrr. Public Strategy Price should not be less than ₹ 500. Qodrr platform will charge per subscription ₹ 500 or 20% of strategy price, whichever is higher.

-

-

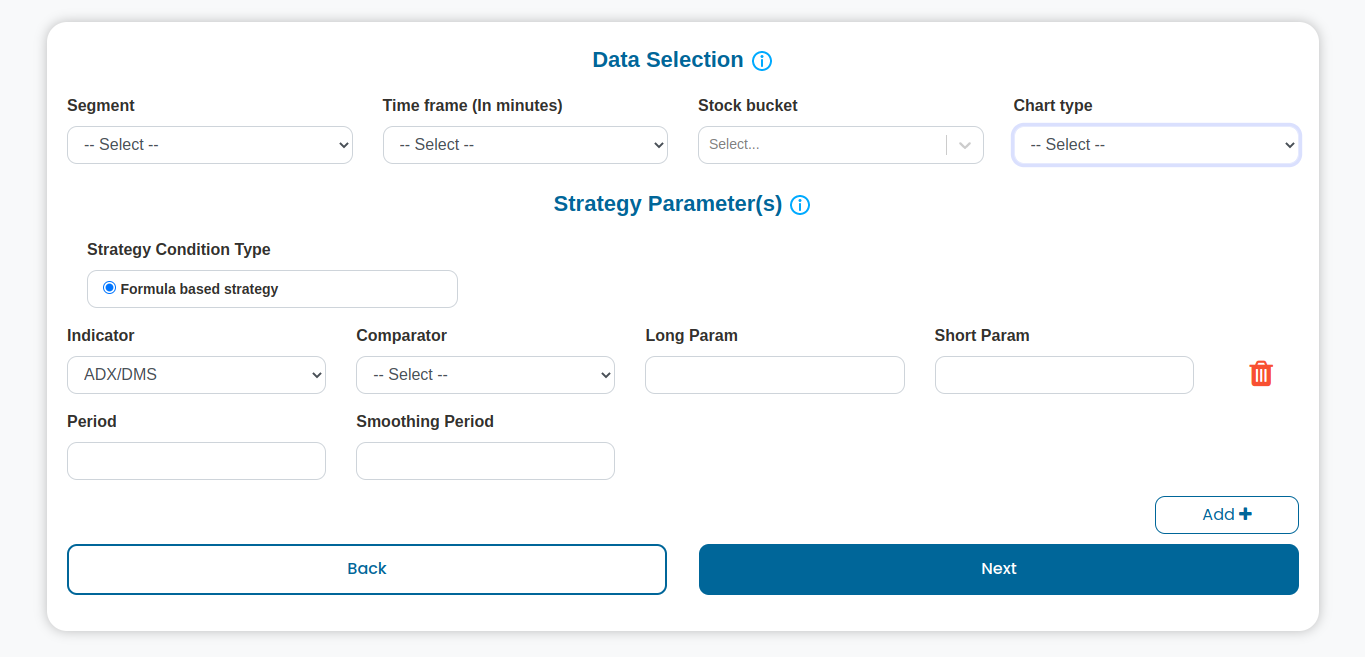

Step 2: Data Selection and Strategy Parameters -

Fill in the details such as segment, time-frame, stock bucket, chart type, indicator, comparator, long param, and short param. Then click on the Next button.

- Segment - Define a segment for your trading plan.Eg: Cash,Future.

- Future : Select to trade NSE future stocks and index contracts

- Multi Commodity : Select to trade MCX instruments

Note

As of now, our platform is supporting Cash, Future, Options, MCX segment. We are working on to support more segments and market.

-

Time Frame - Select timeframe for defining your trading plan. Eg: 15 minute. This timeframe will decide to tranform data in respective timeframe candle.

-

Stock Buckets - Select instruments to be included in your trading plan. Eg: Nifty-I

Important

Our platform works on continuous data of monthly series of future contracts. Nifty-I represent the current month continous data.

-

Chart type - Select chart type for your trading plan. Eg: OHLC Chart

-

OHLC Chart - An OHLC chart is a type of bar chart that shows open, high, low, and closing prices for each period.

-

Renko Chart - A Renko chart is a type of chart that is built using price movement rather than both price and volumn. Our Platform Support Absolute and percentage based brick size.Below fields are mendatory fields, for renko chart

- Renko Box Size Type - Select Renko Box type, either absolute brick or percentage brick.

- Renko Box Size Value - Define renko box size. Eg: 20 for absolute brick or 0.5 for 0.5% brick (No need to enter % sign)

-

Strategy Parameters

Define your strategy's decision making conditions. This will decide the signal generation on selected instrument's data.

-

Strategy Condition Type - This option shows that the strategy is formula based or level based. At this moment our platform is supporting only formula based strategy creation.

-

Indicators - Select the list of indicator to define your trading strategy's decision making. Eg: MACD, RSI, etc.

Note

We are working on to add more technical indicator to our platform. In case, you have any specific indicator to make available on our platform, please reach out to our support team.

-

Comparator - Select Compartor for using technical indicator's value for trading decision making.

- Crosess - Price Point crossess indicator value to generate BUY/ SELL Signal

- Crossover - A Poit of place, where indicator values crossing each other. Eg: 5 SMA crossing 10 SMA.

- Above/Below - Price Point Above/Below the indicator value to generate BUY/ SELL Signal. Eg: BUY below RSI 30 and SELL above RSI 70.

Important

Our platform support Buy and Sell conditions with in the same strategy plan. Eg: Generate a BUY/SELL signal on 5 & 10 SMA crossover or BUY when RSI crosses above 60 and SELL crosses below 40. You can get more information on different indicators usage on indicator configuration page. Below attributes help to define BUY and SELL trigger points with different formula usages.

-

Long Param - Formula value to be considered for BUY(Long) signal condition

-

Short Param - Formula value to be considered for SELL(Short) signal condition

- Segment - Define a segment for your trading plan.Eg: Cash,Future.

-

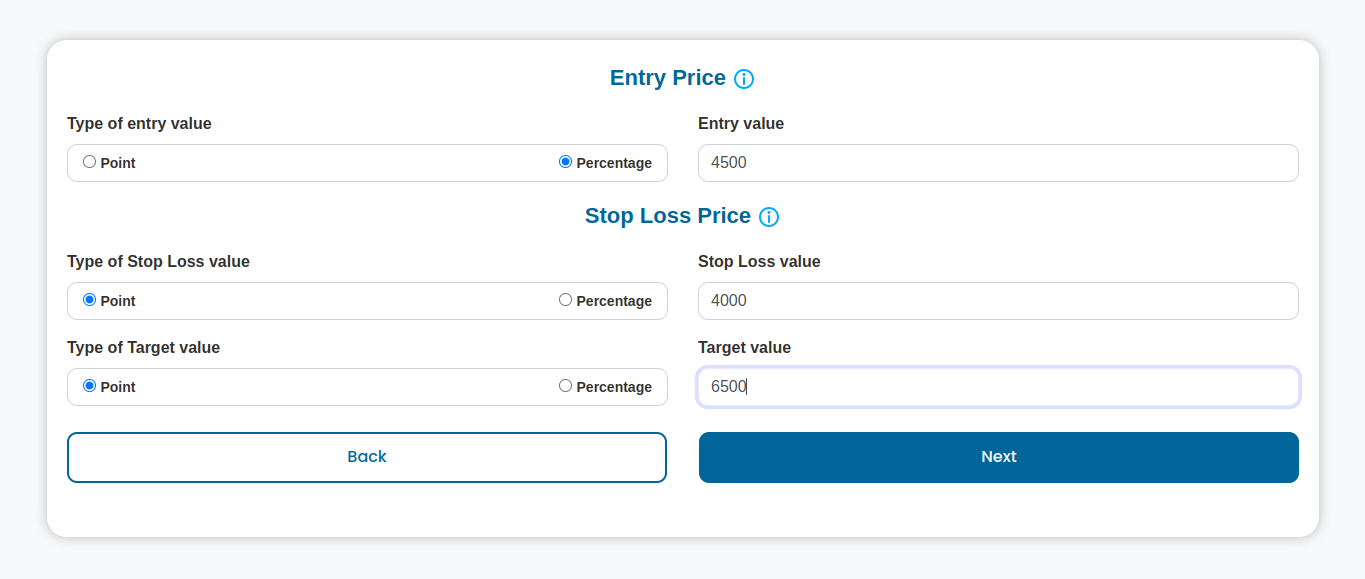

Step 3: Strategy Exit/Entry Points -

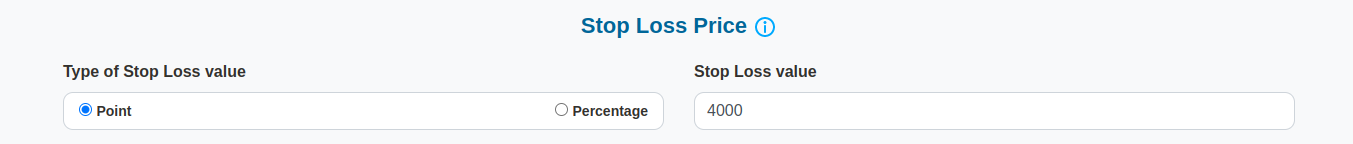

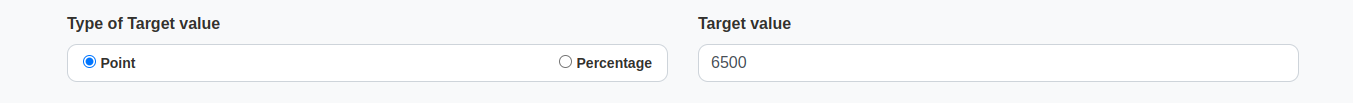

Details like entry value, stop loss value, and target value, are to be filled. Then click on the next button.

- Entry Price - Entry price to get into the trade with point difference on generated price point. Price point can be absolute point value or percentage. Eg : 20 or 0.2.

- Stop loss Point - Stop loss point for the trade. Stop loss point can be absolute point value or percentage. Eg : 20 or 0.2

- Target value - Target value for the trade. Target value can be absolute point value or percentage. Eg : 20 or 0.2

-

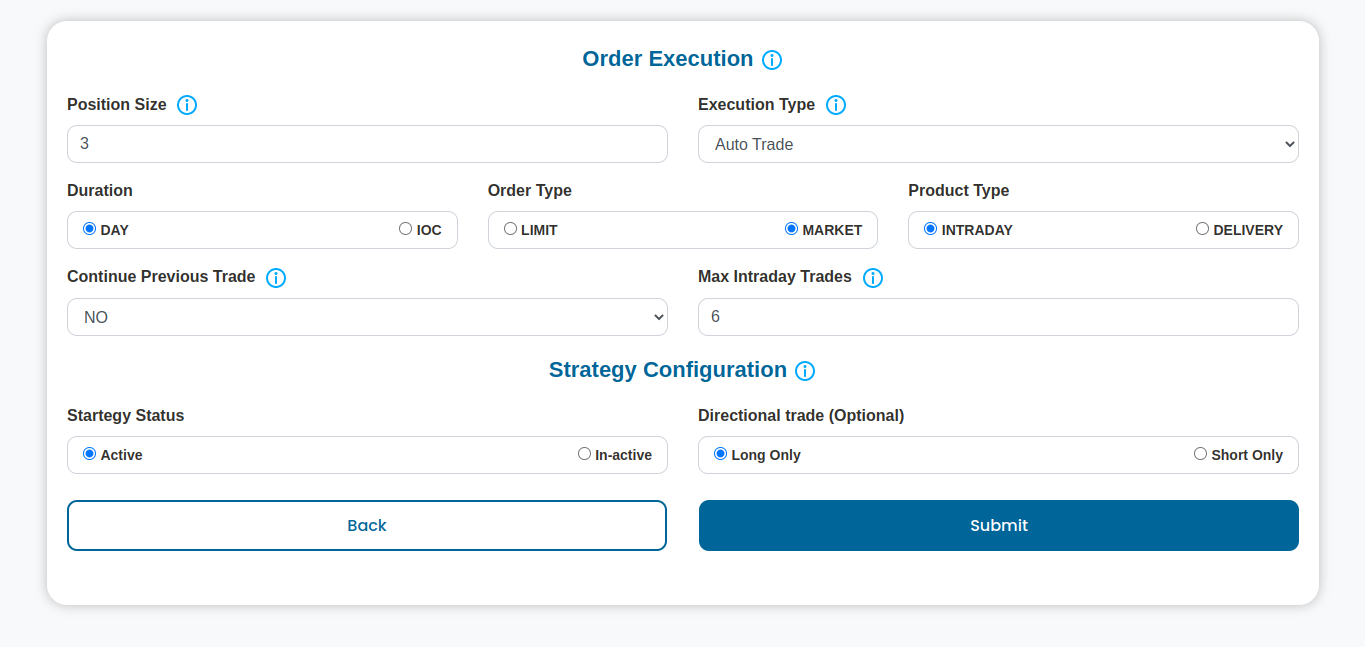

Step 4: Order Execution And Strategy Configuration -

Fill in the details such as position size, execution type, duration, order type, product type, continue previous trade, maximum intraday trades, strategy status, and directional trade. Then click on the submit button.

-

Position Size - Define the Position size for your trade. Eg: 100 denotes, 100 share in case of segment is cash. 1 denotes, 1 contract (Lot) in case of future, options, MCX. Let's say, you want to take a 1 lot Nifty Position in your strategy. Then, keep position size value as 1 in the field.

Note

Our platform internally manage the quantity to be used for sending order to broker window of variour future and options instruments based on current lot size.Hence, you should only define the number of lots to be considered for order.

-

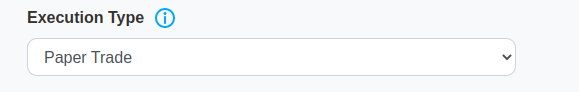

Execution type - Our platform provide different strategy execution options as define below. Choose appropiate execution type for your strategy.

-

Paper Trade - Paper trading is simulated trading that allows investors to practice buying and selling securities without risking real money. Paper trading can test a new investment strategy before employing it in a live account.

-

Auto Trade - Automated trading systems allow traders to establish specific rules for both trade entries and exits that, once programmed, can be automatically executed via a computer.

-

Notify Trade - When you want to skip real-time trade and just want to get a notification you can click on the notify trade option.

-

Manual Trade - Manual trading is a trading process that involves human decision-making for entering and exiting trades. This is in contrast to automated trading which is executed automatically by our platform.

Note

Execution type selection varies according to the active platform subscription plan for your account. For more details, kindly check subscription plan page.

-

-

Duration - A Day order is valid till the end of the trading day. It gets canceled automatically if unexecuted before the closing of market hours. An IoC (Immediate or Canceled) order is either executed immediately or else gets canceled.

-

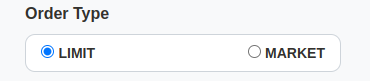

Order type - An order type is a pattern in which investors want their stock brokers to execute a stock market trade on the exchange.

-

Limit order - Limit order is an order to buy or sell a security at a specific price or better. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher.

-

Market Order - Market order is an order to buy or sell a security immediately. This type of order guarantees that the order will be executed, but does not guarantee the execution price.

-

Important

We encourage to use market orders, than limit order for sure order processing.

-

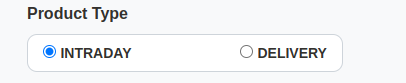

Product Type - It shows whether the trade being done is an intraday trade or a delivery trade.

-

Intraday - If strategy should work as intraday trading plan, then select this option.

-

Delivery - If strategy should work as delivery (carry forward for next day), then select this option.

-

-

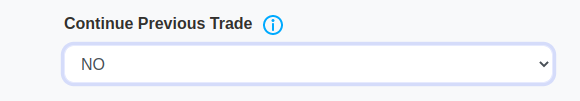

Continue Previous Trade - This feature allow us to ride a long running trade. Eg: Current signal is BUY and you don't have any open position for this strategy.

- If value for this option is selected as NO then it'll not execute any order.

- If value is selected as On Market Open, then previous trade signal will be executed on market open.

- If value is selected as Always, then it'll always open a trade position if trade log doesn't have any open position. Eg: If SL hit or Traget Hit, if this option is selected, then it'll put you back into the same trade in next run.

- Maximum Intraday Trades - The number of times you want to execute your trade in a day. Default value will be 0. Which means, no limit on intraday order execution. This Option is usefull to implement proper risk management in case of volatile market.

Strategy Configuration - Here, you can configure your trading strategy.

- Strategy status - It shows whether your current strategy is active or inactive.

- Directional Trade - You can choose, if you wish to take trade in one particular direction of the market from this strategy.

-

-

Step 5 Validation and saving strategy

After finishing all 4 steps, you can click on submit button.It'll save your strategy and validate the strategy decision making logics. If all are good, then you'll receive validation successful message on screen.if not, then you will get validation error.Check your strategy parameters in step 2 again and retry to submit. Once the Strategy has been validated and saved, then you are good to go for deployment of strategy or paper trading a strategy.